Calculating portfolio rate of return

Well, that got complicated quickly

TL;DR?

It seems that TWR shows the underlying performance of the portfolio whilst IRR shows the effectiveness of execution.

Things being what they are, I’ve been studying investing and trading fulltime for about a year now, finding out what works for me and what doesn’t, so I thought it’s about time to review the year and see how I’ve done and, in particular, if I’m doing better than I would just sticking the whole lot in an S&P 500 tracker and doing something else as a day job.

Turns out I didn’t even know the question, let alone the answer. “42”, anyone?

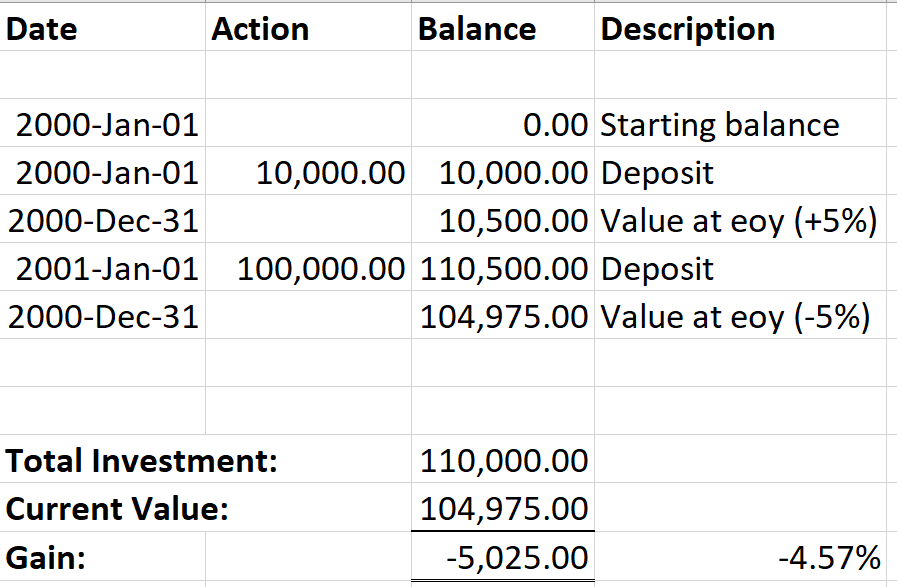

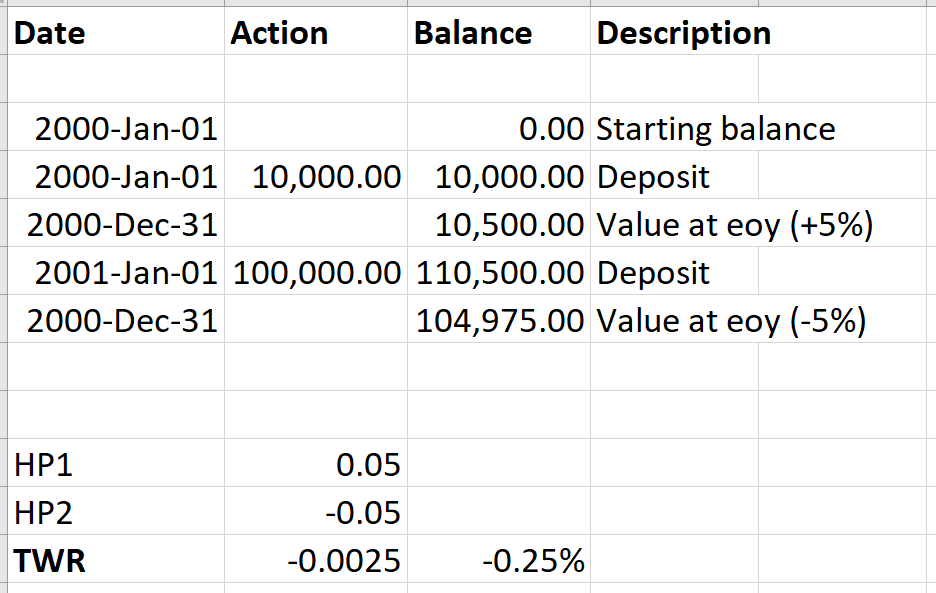

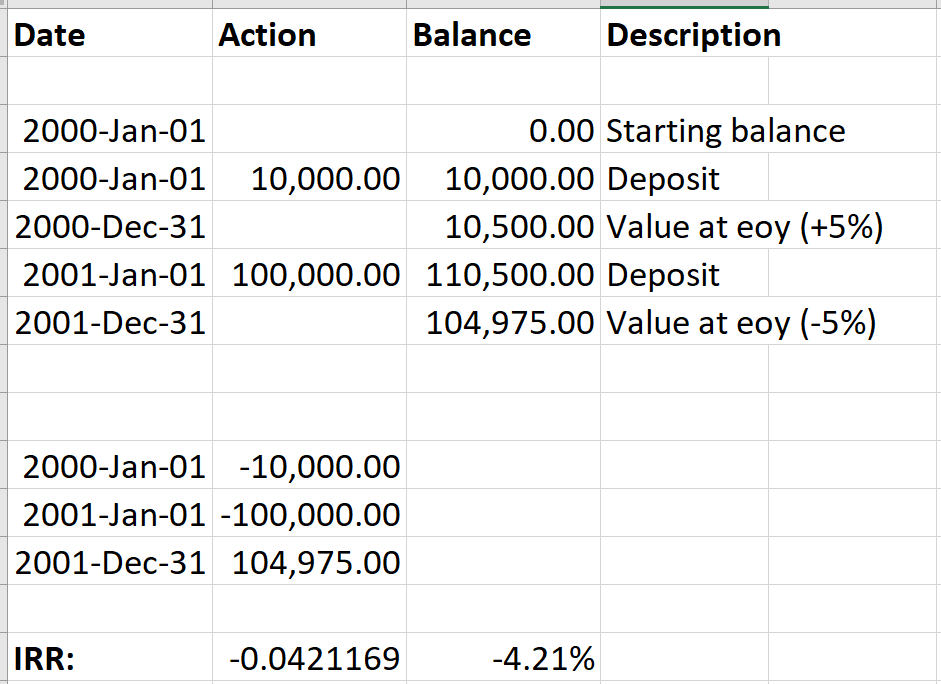

Consider two years where I start by investing $10,000, have a gain of 5%, then invest 100,000 and have a loss of 5%:

So, overall, I have a loss of 4.57%. But what’s my annual rate of return?

This, of course, is complicated by the fact I added a significantly larger sum at the start of year 2. So, let’s examine some cases:

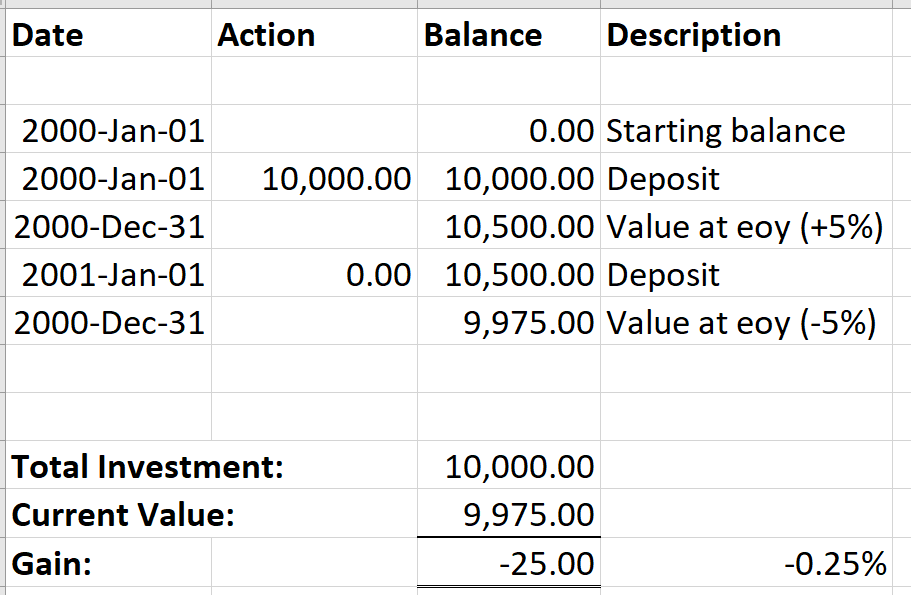

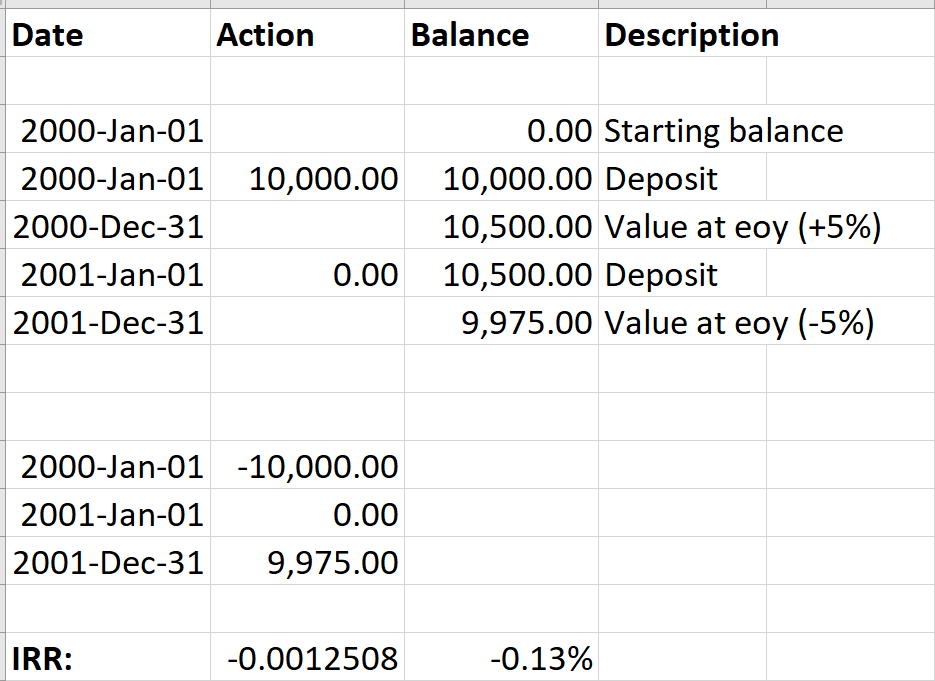

A single deposit for two years

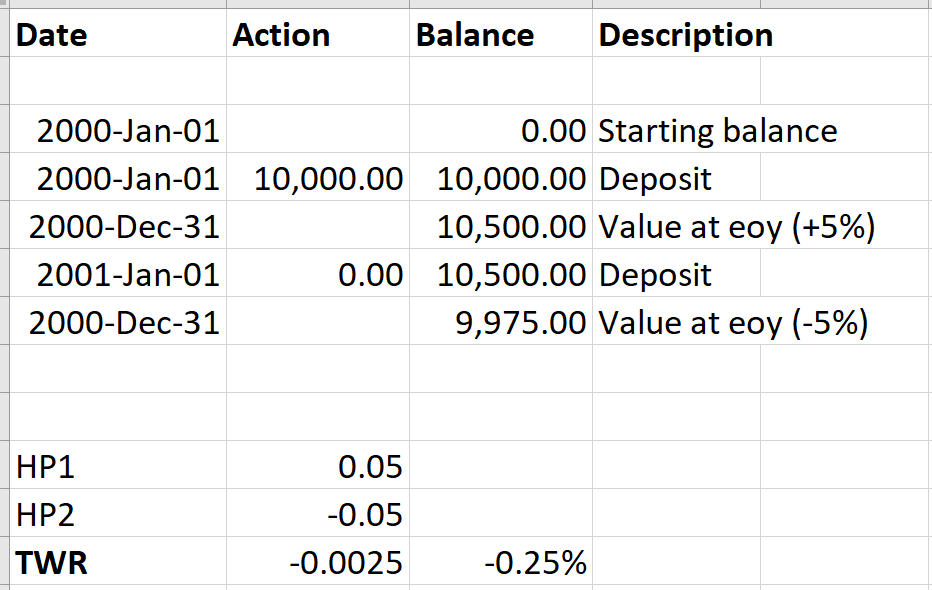

Let’s remove the second deposit. We get the same 5% gain in the first year and 5% loss in the second year to get an overall loss of -0.25%:

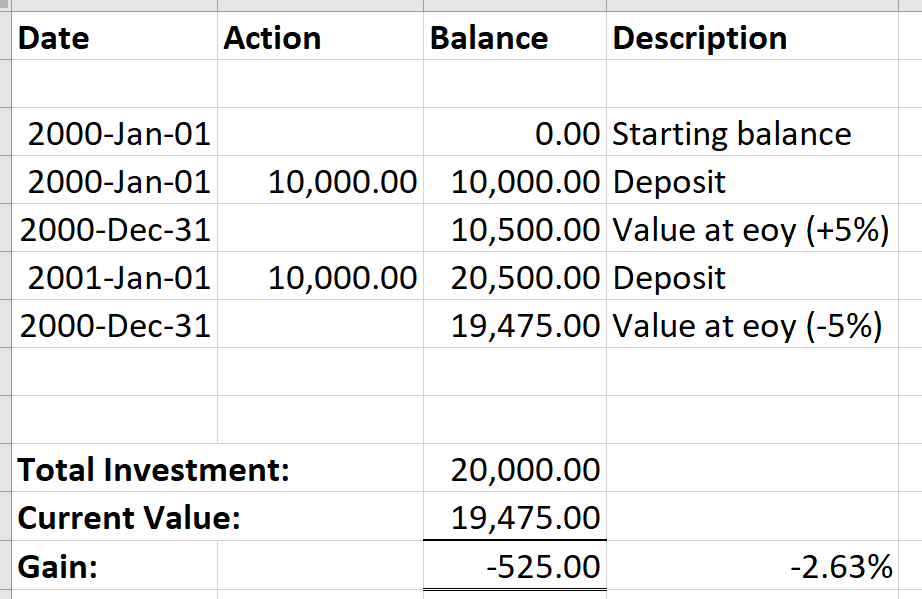

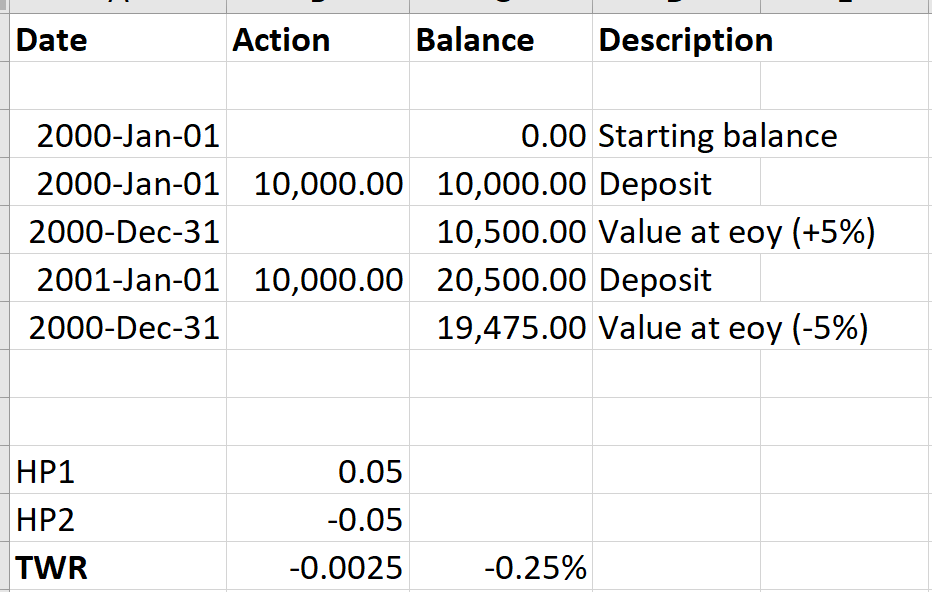

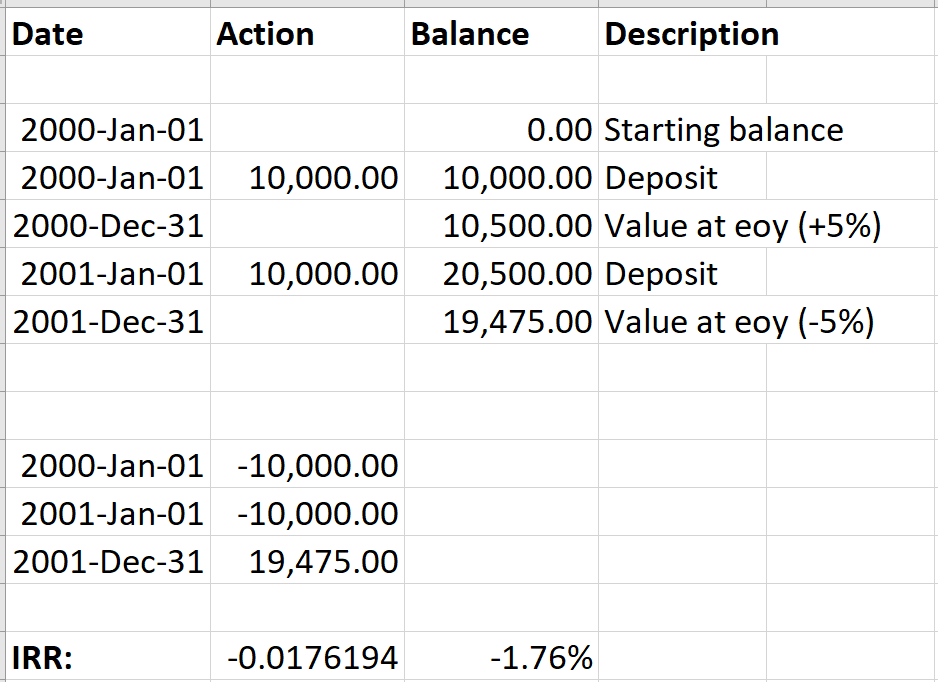

Two equal deposits

Now let’s examine two equal deposits. We now see an overall loss of -2.63%:

Let’s keep those numbers in mind.

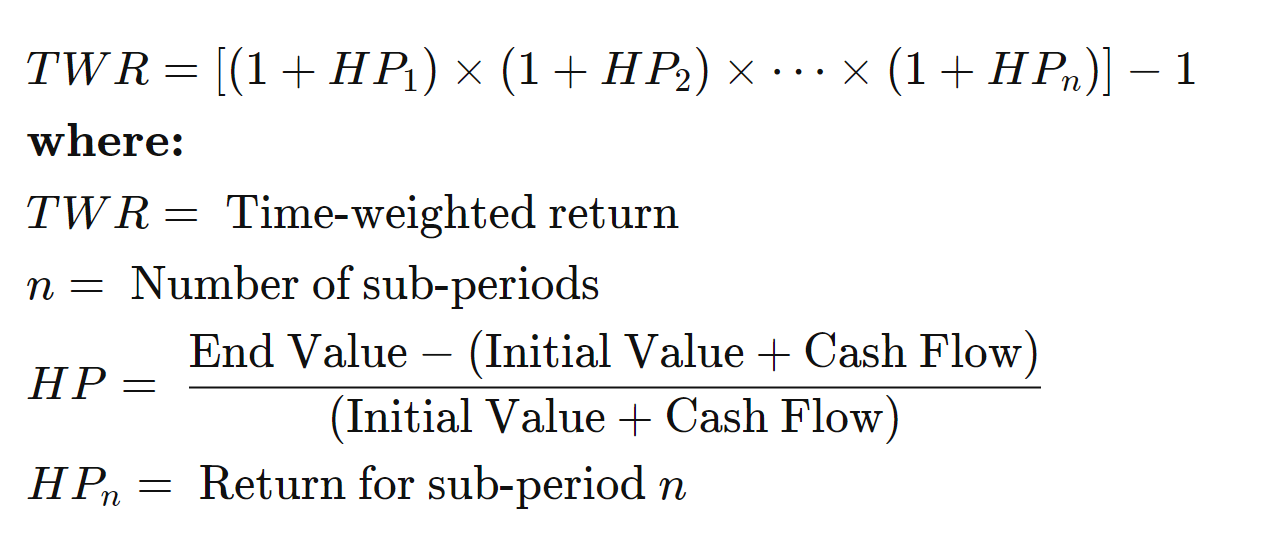

Time-Weighted Return (TWR)

Investopedia defines this as below, which is simply the product of the returns for each of the two years:

In our original example this gives a TWR of -0.25%:

And in the other two examples:

Internal Rate of Return (IRR)

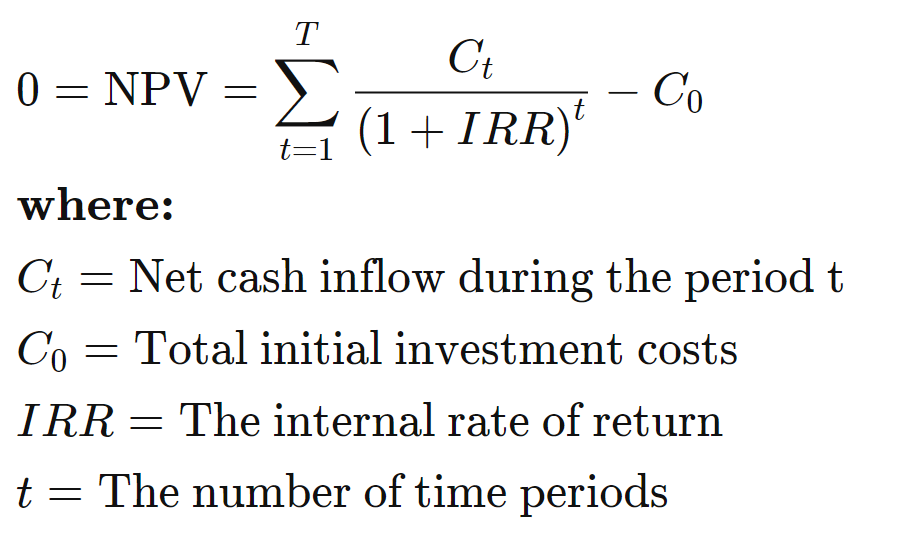

Investopedia defines this as below, which is simply the average rate of return over each year required to produce the final value1:

Let’s run those same three examples again:

Summary and Conclusions

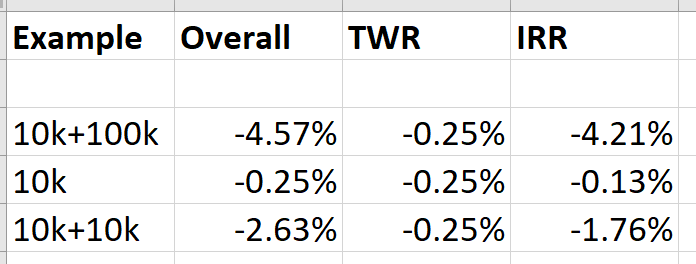

So, to summarise the results in the three cases examined:

It would appear that TWR is independent of deposits, whilst IRR reflects them.

Thoughts

It seems that both TWR and IRR have merit, each measuring different aspects of the investment:

TWR measures the annualised return of the portfolio (stock, fund, bond, etc.).

IRR measures the annualised return of the portfolio itself: the stock movements plus the impact of when capital was allocated.

Thus is seems that TWR shows the underlying performance of the portfolio whilst IRR shows the effectiveness of execution.

Comments welcomed.

This is difficult to calculate directly so an iterative process is used, such as Excel’s XIRR() which gives an approximate answer.